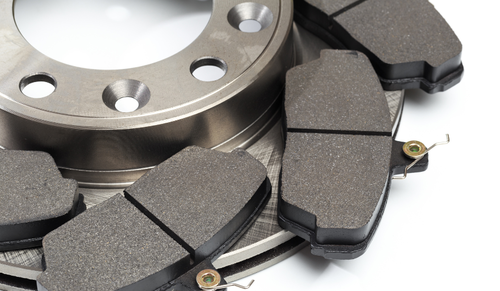

The adhesives used in vehicles keep drivers safe, comfortable, and in control by bonding materials that have opposite but complementary properties. Adhesives hold together the diverse parts of our cars, from the dashboard to the windshield to door panels and carpet to the exterior trim and brakes and suspension—to name a few. The list of where adhesives are applied is long and growing.