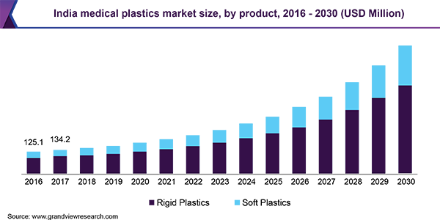

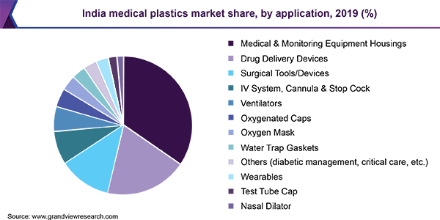

The India medical plastics market size was valued at USD 156.6 million in 2019 and is expected to expand at a compound annual growth rate (CAGR) of 15.2% from 2020 to 2030. Rising healthcare expenditure, increasing government support to improve the healthcare sector, coupled with the rising positive coronavirus cases in the country, is expected to positively influence the demand for medical devices, thereby propelling the demand for medical plastics in the country. Amid the global COVID-19 pandemic situation, the country is witnessing a significant demand for medical devices, such as ventilators, drug delivery devices, and medical monitoring equipment. Several automotive manufacturers including Ashok Leyland, Hyundai India, MG Motors, and Maruti Suzuki turned to produce ventilators in order to meet the rising demand with the increasing corona positive cases in the country. Thus, the growing medical device industry in India is anticipated to propel the demand for medical plastics during the forecast period. India depends on imports for approximately 86% of its domestic requirements of medical devices. The country imported medical devices worth USD 6,644.3 million in FY2019. The government interventions have helped the medical devices industry to expand production during the pandemic. Manufacturers of medical devices and components have witnessed a surge after the outbreak of COVID-19. In July 2020, the Ministry of Chemicals and Fertilizers launched four programs for the Department of Pharmaceuticals for the promotion of domestic manufacturing of medical devices and bulk drug parks in the country. This program was initiated in line with the vision for making India self-reliant. Thus, the increasing focus and support of the Indian government on promoting self-reliance in the pharma sector is anticipated to propel the local production of medical devices and components. This, in turn, is further projected to create lucrative opportunities for medical plastics in India over the forecast period. Product Insights The rigid plastics segment led the market and accounted for more than 72.0% share of the overall revenue in 2019. This is attributed to properties such as excellent mechanical, chemical, and biocompatibility levels, making it suitable for producing a wide range of medical products, such as electronic housings, surgical tools, drug delivery systems, oxygen masks, and ventilators. Amid the global COVID-19 pandemic, the demand for healthcare products, such as oximeters, thermometers, and blood pressure monitors, has increased, which is also driving the demand for rigid plastics in India. Polystyrene possesses properties such as resistance to gamma radiation and photolysis, rigidity, and transparency. Polystyrene offers easy sterilization, which makes it suitable for use in the manufacturing of test tubes, tissue culture trays, diagnostic components, Petri dishes, housings for test kits, and medical devices. Polystyrene is also used in the manufacturing of cabinets and housings for electronics, such as computers. Additionally, polystyrene is used in various industries, such as automotive, packaging, building and construction, and consumer goods. Soft plastics are often used for manufacturing seals and gaskets, pipe and tubing, catheters, drug delivery systems, and various others. Amid the global COVID-19 pandemic, the demand for drug delivery systems and tubing used in ventilators has increased, thus propelling the demand for soft plastics in the market. Application Insights The medical and monitoring equipment housings application segment led the market and accounted for more than 34.0% share of the overall revenue in 2019. These medical equipment housing products are used in the assembling of a wide range of medical devices, such as ventilation monitoring systems, heart rate monitors, breath monitors, ECG machines, electronic thermometers, and medical robotic enclosures. Amid the global COVID-19 pandemic situation, the demand for oximeter has increased, which is expected to drive the segment over the forecast period. Drug delivery devices are a more effective method of medication compared to the conventional oral methods of medication. Acrylonitrile butadiene styrene (ABS), thermoplastic elastomer (TPE), and polycarbonate are primarily used in the manufacturing of drug delivery systems. These plastics offer properties such as biocompatibility, high impact resistance and toughness, stiffness, lower level of residual monomer and oligomer, and a wide range of colour options from completely transparent to opaque. Drug delivery devices are used in insulin delivery for diabetes, pain management, vaccine delivery, pediatric injections, and various others. Nasal dilators are used to improve the flow of air through the nose while sleeping, which effectively reduces snoring. The internal nasal dilators and external nasal dilators are the two types of nasal dilators. Nasal dilators are non-medicated and easy to use and provide instant relief with absolutely no side effects. Source: https://www.grandviewresearch.com/industry-analysis/india-medical-plastics-market