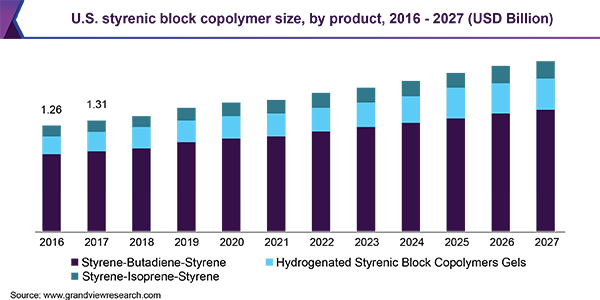

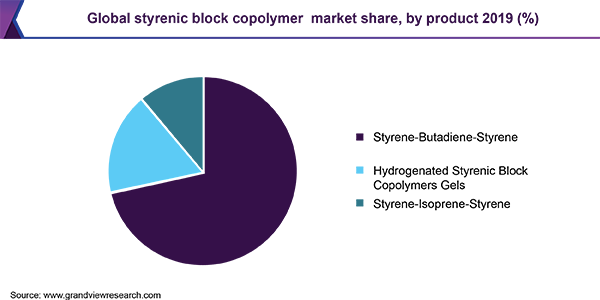

The global Styrenic Block Copolymer market size was valued at USD 7.4 billion in 2019 and is expected to expand at a CAGR of 4.6% from 2020 to 2027. The market is expected to be driven by the rising demand from various applications such as footwear, adhesives and sealants, polymer modification, paving and roofing, and medical devices. Rising positive coronavirus cases across the globe have upsurge the demand for medical components such as tubing, bags, and IV drip chambers. This, in turn, is further projected to propel market growth. Styrenic butadiene copolymers represent a versatile family of resins for adhesive and sealant development. Formulations prepared with styrenic block copolymer resin as a base polymer offer a unique combination of properties and find applications in diverse markets. Various styrenic block copolymer properties such as crystal clarity, design versatility, high resistance, excellent thermal stability, and stabilizability by gamma irradiation, ethylene oxide gas, and mutagenic or irritant potential are anticipated to drive the market. Styrenic block copolymers (SBC) are used in various applications across medical sector, such as medical stoppers, IV bags, IV tubing, IV bottles, IV drip chambers, IV connectors, comfort bedding, films, and orthopaedics and respiratory equipment. Properties such as high transparency, flexibility, good mechanical strength, kink resistance, softness, and excellent UV and chemical resistance are propelling the demand for styrene block copolymers in medical applications. The growing need for a substitute of Polyvinyl Chloride (PVC), owing to various hazards associated with its use, has been driving the demand for styrene block copolymers in the medical sector. In addition, several advantages of hydrogenated styrene block copolymers over polyvinyl chloride in medical application, such as flexibility, lightweight, higher temperature resistance, and no added plasticizer among others, are driving the demand. Styrenic block copolymer is widely used in footwear applications. Its properties such as excellent elasticity, gas barrier, slip resistance, flexing endurance, wear resistance, and low-temperature resistance are propelling the demand for styrene block copolymer in footwear application. In addition, a higher coefficient of friction of styrene block copolymer shoe soles on wet and asphalt road surfaces as compared to other materials such as polyvinyl chloride- and vulcanized rubber-based shoe materials is anticipated to boost the demand for styrene block copolymer significantly over the forecast period. However, the fluctuation in crude oil prices has a significant impact on the price of styrene block copolymers. As the major raw material such as benzene, ethylene, and propylene are generally derived from crude oil derivatives, thus any fluctuations in crude oil prices significantly impact the pricing of the final product. Product Insights The SBS segment led the Styrenic Block Copolymer market and accounted for a revenue share of more than 71.0% in 2019. This growth can be attributed to the rising demand from polymer footwear, construction, and adhesives and sealants industry. In the construction industry, SBS is used for paving and roofing application. SBS used in modified bituminous roofing materials to offer various characteristics including excellent waterproofing properties, resistance to thermal degradation flexibility over a wide range of temperatures, performance over long-time periods, and enhanced aesthetic. Increasing construction spending in emerging economies and infrastructure development activities, especially in emerging economies of the Asia Pacific and the Middle East, are the major factors driving the demand for SBS in paving and roofing application. Construction is one of the major industries that have been hugely impacted by the outbreak of COVID-19 across the globe. Halted or a slowdown in construction activities, movement restriction, shortage of labour as a result of measures to contain the COVID-19 outbreak have restrained the growth of construction industry, which, in turn, are anticipated to hamper the demand for SBS in paving and roofing and adhesives and sealants applications. Regional Insights The Asia Pacific dominated the market and accounted for a revenue share of over 43.0% in 2019. Rapid expansion in the construction sector, due to government schemes promoting basic amenities and growing need for affordable housing, is driving the growth in emerging economies such as India, China, and Indonesia. Furthermore, growing consumer awareness and stringent regulations regarding carbon footprints are expected to promote the development of green buildings. This is likely to drive the demand for lightweight and sustainable materials such as styrene block copolymers. The rise in demand for permanent houses in rural areas of emerging economies such as India and South-East Asian countries is expected to drive the demand for durable, low-cost roofing systems. The market is likely to benefit from rising investments in residential and non-residential construction sectors by the government as well as foreign players to provide sustainable housing and commerce facilities in economies such as India, Vietnam, Thailand, and Indonesia. Increasing product demand from paving and roofing applications and strong infrastructure development in Canada and Mexico are anticipated to drive the market for styrene block copolymer in North America over the forecast period. Approval from the U.S. FDA and the U.S. Pharmacopoeia to use these block copolymers in the medical industry to reduce dependency on PVC is expected to augment market growth. In Europe, factors such as the recovery of the overall economy and growth of end-use industries such as footwear, automotive, and infrastructure are anticipated to drive the market in the region over the forecast period. Countries such as Germany, France, Italy, Russia, and the U.K. are the major producers and consumers of these block copolymers. Polymer modification is one of the major application segments and is set to play an important role in the growth of the overall industry. Source: https://www.grandviewresearch.com/industry-analysis/styrenic-block-copolymers-sbcs-industry