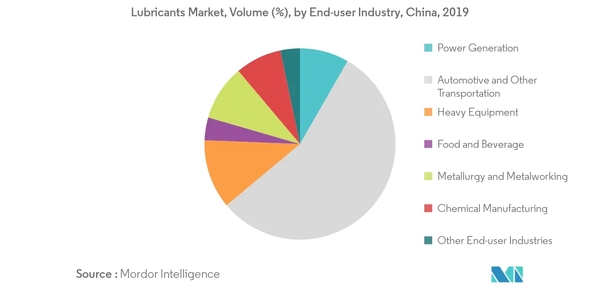

Market Overview The China lubricants market is expected to register a CAGR of over 2%, during the forecast period. One of the major factors driving the growth of the market is the increasing usage of high-performance synthetic lubricants. ●On the flipside, the growing demand for electric vehicles and the impact of COVID-19 pandemic are likely to hinder the market growth. ●Automotive and other transportation segment dominated the market in the country. Key Market Trends ●Process oils are used in the chemical, textile, and personal care industries, as well as in the manufacture of plastics, polymers, yarns, fabrics, cosmetics, and other products. ●Naphthenic oil is one of the major types of process oils widely used for manufacturing various products (including rubber, inks, plasticizers, and sealants, among others). ●Naphthenic process oils are light-colored and non-staining compounds, which have properties, such as thermal stability, compatibility with synthetic elastomers, greater solvating power than paraffinic oils, and low viscosity. ●In general, process oils can be segmented into white oil and rubber process oil, which have diversified applications in numerous industries. ○Process oils increase the performance of rubber and tire products and provide high stability, with a relative inertness toward curing additives. Process oils have low volatility, high viscosity, and plasticity. These properties facilitate the blending and dispersion of fillers in tire and rubber products and improve their elastomer workability. ○The process oil segment witnessed a clear inclination toward the use of high-purity products over the recent years. The manufacturers in numerous sectors are looking for process oils that have low concentrations of aromatics, polycyclic aromatic structures, sulfur, nitrogen, and volatile components. ○Besides, rubber process oils function as internal lubricants, which improve the blending of rubber formulations, facilitate the incorporation of fillers and other additives, improve certain physical characteristics, and function as low-cost extenders. ○Rubber process oils are widely used in the manufacturing of automotive tires and tubes, bicycle tires, tires retreading materials, belting, hoses, bottles, battery containers, extruded products, and technical molded goods. ○Due to the declining automotive production, the demand for tires and rubber products has been affected. Due to this, the process oil market is likely to witness repercussions. ○White oil, a type of process oil, is a highly refined mineral oil, consisting of saturated aliphatic and alicyclic nonpolar hydrocarbons. It is hydrophobic, colorless, tasteless, odorless, and does not change color over time. Owing to such properties, white oil is used as a blending base in pharmaceutical and personal care products. Low-volatility white oil is also used in the production of plastics and adhesives. ●For instance, it is used as a flow rate controller in the production of polystyrene, an extender in the non-vulcanized fabrication of thermoplastic elastomers and a diluent in hot-melt adhesives. ●With the increasing demand from various sectors in the country, the consumption of process oils is expected to boost, during the forecast period. Heavy Equipment Segment to Drive the Market Growth ●Lubricants prevent premature failure and decline in the performance of construction equipment, which are subjected to extremely harsh operating conditions of heat, dirt, and moisture. Various lubricants perform functions to safeguard construction equipment from bearing failures, short life-span of engine oil, lower resistance of diesel fuel to water, rusting of cables, ropes, and draglines. ●The country’s economic growth has been high, but it is gradually veering toward moderate (as the population ages and economy rebalances from investment to consumption, from manufacturing to services, and from external to internal demand). ●Despite volatile growth in the real estate sector, significant development of rail and road infrastructure by the Chinese government (in order to withstand the demand stemming from the growing industrial and service sectors) has resulted in a significant growth of the Chinese construction industry in recent years. China’s construction industry witnessed more than 4% growth in 2019 and accounted for a major proportion of China’s GDP. ●As the construction industry is dominated by state-owned and private enterprises, increased government and private spending in this regard is pushing the industry toward global primacy. China has the largest construction market in the world. Residential real estate development can be considered as a main driver of China’s economy. ●In the recent past, the entry of major construction players (from the European Union) in China has further fueled the growth of this industry. ●Post recovery from the COVID-19 impact, the expansion of the construction sector in China is estimated to drive the demand for lubricants used for heavy equipment in the construction sector (such as penetrating and coating wire rope lubricants, engine oil, and bearing grease) is expected to increase over the forecast period. ●The mining industry has been growing at a rapid pace over the past decade, owing to the large number of mines in the country, which are mostly owned by the government. China is the largest producer of various minerals, along with coal and gold. In addition, it is the largest consumer of such mining products. ●China was the largest gold producer in the world in 2018, and it accounted for around 12% of the total global production. However, mining operations for major products, such as iron ore, coal, and gold have been hit in early 2020, in turn effecting the overall output and number of operating mines in the country for a brief period. source:https://www.mordorintelligence.com/industry-reports/china-lubricant-market