The global lubricants market size was valued at USD 126.5 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 3.6% from 2020 to 2027. The global manufacturing sector has a direct impact on the lubricants demand as they are used in numerous industries including paper and mill, metal forming, foundry, mining, quarrying, energy, plastics, food and beverages, and machining. Lubricants are extracted from crude oil, which undergoes a preliminary purification process, known as sedimentation before it is pumped into fractionating towers. The crude oil is then heated in huge fractionating towers. The various vapors which can be used to make fuel, are boiled off & are collected at different points in the tower. The market dynamics have been witnessing changes, in terms of raw materials owing to the establishment of stringent environmental compliances and rising demand for bio-based products. Source:https://www.grandviewresearch.com/industry-analysis/lubricants-market

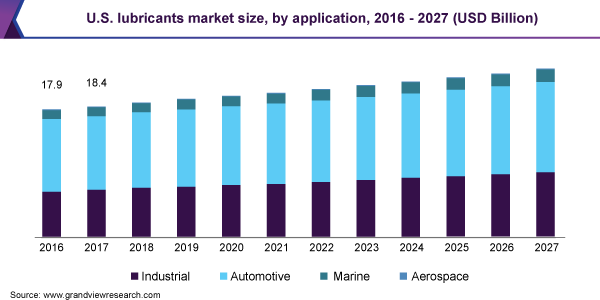

The market for lubricants in U.S. was driven by the consumption of lubricants from the automotive industry which accounted for a share of 57.7%, in terms of volume, in 2019. However, on a global scale of market movement, the industry reflected an economic malaise which eventually led to an overall flat year, thereby dampening potential prospects for automobile suppliers and manufacturers. U.S. automotive production witnessed a decline and major manufacturing companies shifted their production bases to Mexico, due to easier trade policies with Asia and Europe. These factors are projected to hinder the demand for automotive lubricants in U.S.

Furthermore, the U.S. lubricant industry has made constant progress in terms of producing advanced quality products with longer oil drain intervals. This resulted in lower consumption of oils and greases as a result of higher efficiency. Bio-based industrial lubricants in U.S. marketspace are growing due to the stringent regulatory norms regarding environmental deterioration, which in turn, is expected to act as a restraining factor for synthetic lubricants over the foreseeable future.

However, from a global perspective, the manufacturing sector has witnessed robust industrialization over the past few years on account of fragmentation of production at the international level and intensification of trade in sophisticated manufacturing goods. The industrial sector exhibited positive development after the recent recovery in BRICS economies post the 2009 recession and is anticipated to further witness significant growth. Growth drivers for the manufacturing sector in the market for lubricants include favorable foreign investment norms, availability of a large pool of skilled labor, and technological know-how.

More productive and cost-effective manufacturing techniques, increased M&A, and the reshoring of factories at low-cost manufacturing economies, have been the key drivers for industrial growth. Hence, rapid industrialization in BRICS is expected to drive industrial lubricant demand which in turn is expected to complement market growth.

Despite the growth of the manufacturing sector across different economies, global lubricant consumption is anticipated to be hindered by the rising inclination towards bio-based alternatives. The demand for bio-based lubricants is growing at a rapid pace. North America and Europe have emerged as the largest consumers of these products owing to the stringent environmental protection policies and also the rising awareness amongst the regional consumers.

Furthermore, the global coronavirus outbreak has caused noteworthy changes in operations of multiple industries, including oil and lubricant marketspace. In the early stages of the first quarter of 2020, it was projected that the impact shall be havoc for the market in China, however, with outbreak of the virus spread beyond Asia, the future projects of oil demand, price, and supply looks grim worldwide. There are two subtle ways that are predicted in this scenario. Firstly, due to containment efforts taken by all governments across Asia Pacific, North America, and Europe, the travel restrictions shall cause limited utilization of jet fuel, which will lead to slower supply chain movement in the oil industry.

Further, as several workers are sent home, industrial activities have slowed down significantly, which directly implies towards lower production as well as consumption of oil and oil-derived products. Secondly, the virus spread had a significant impact on the stock market which creates a second impact assumption base for the oil industry. As health of the global economy declines, the market sentiments will directly impact the oil curve in the foreseeable future, which is projected to prompt flight from the energy as well as oil and gas sector stocks, thereby leading to further downfall of oil prices.

Crude oil is a key feedstock for the production of lubricants and the virus outbreak has led to oil price downfall for the third consecutive day in March, which reflected 17 years low of the U.S. crude industry. However, looking at the end-use markets of lubricants, the automotive sector has been a crucial part of the ecosystem worldwide. Major automakers from across the globe rely on China to outsource their automobile parts and components. With disrupted supply chain and complete operational shutdown in China, the automotive sector took a significant hit globally. Although the key automobile manufacturers are improvising strategies to continue smooth operations, however, the duration of the coronavirus pandemic is still not traced to the end, which will directly lead to sustained discrepancies in the supply chain of the industry.