The TPE industry has enjoyed steady, fairly-high growth for 30+ years based on favorable general properties (elastic and thermoplastic), relatively low cost of the major polymers used (polyolefins, styrene block copolymers, elastomers) and fabrication process advances (coextrusion, overmolding, foaming, adhesion, scratch/mar improvement). As the industry has matured, new challenges are opening markets, creating value-added opportunities and an inflection point in growth of the TPE industry. Automotive TPE market

The inflection point

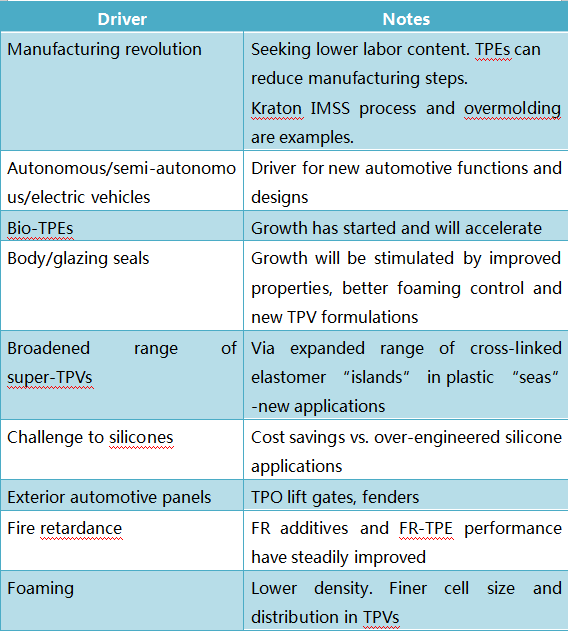

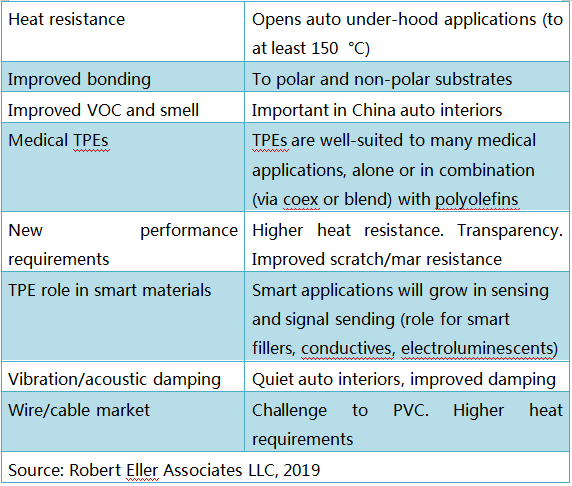

In addition to the well-established TPE advantages, some of the factors that will drive up TPE demand and value at and beyond the inflexion point are briefly listed in table 1.

Tab. 1: Factors driving up TPE value and demand at the inflection point

The automotive market is important for TPEs (especially TPO, SEBS, TPV, COPE) as described by this author and others.The automotive market is undergoing a revolution in production methods, performance requirements (heat resistance, scratch/mar resistance, VOC). The penetration by TPOs into exterior panels (lift gates and fenders for example) and new approaches to foamable TPV formulations based on polyolefin blends (olefin block copolymers and random copolymers, possibly with silane cross-linkers) are examples of new approaches driving increased automotive TPE growth opportunities. The anticipated slowdown in global automotive sales from the current level of ~ 87 million vehicles could dampen optimism for automotive TPEs but looking only to organic growth of vehicle demand (typically 3 %/y) will lead to an over-cautious approach. It is likely that TPE demand growth will come from light weighting and new automotive functions such as smart applications (smart TPEs capable of sending/receiving signals, displays, acoustic controls, continued growth of new applications (exterior TPO panels for example) and the trend to larger vehicles which is driven, recently, by lower fuel costs.

Globalization of auto production is one of the factors that has driven US and European TPE compounders to produce in Asia and to stimulate recent investment in India. Reverse globalization (e.g. Chinese and European compounders investing in NAFTA) has also been described. Shifts in the automotive supply chain are drawing Chinese compounders, component producers and suppliers of advanced vehicle and component manufacturing technologies to NAFTA An excellent listing of several types of Chinese automotive investments illustrates how the Chinese advanced automotive component manufacturing base and TPE compounders are beginning to evolve in NAFTA. Not surprisingly, many of the Chinese advanced component, R/D, connected vehicle, autonomous vehicle, sensor system companies are located in or near Silicon Valley.

TPE magazine TPE_01-2019